(Originally posted: April 10, 2018)

Tax season; the forever dreaded and unavoidable chore we must complete by April 30th every year. With this years deadline fast approaching most people are wondering, have they claimed everything possible? Perhaps a missed invoice for hearing aid batteries, or other medical devices purchased last year. At Davidson’s we are always happy to provide client’s with any invoices they may have tucked away, or lost. Every penny counts!

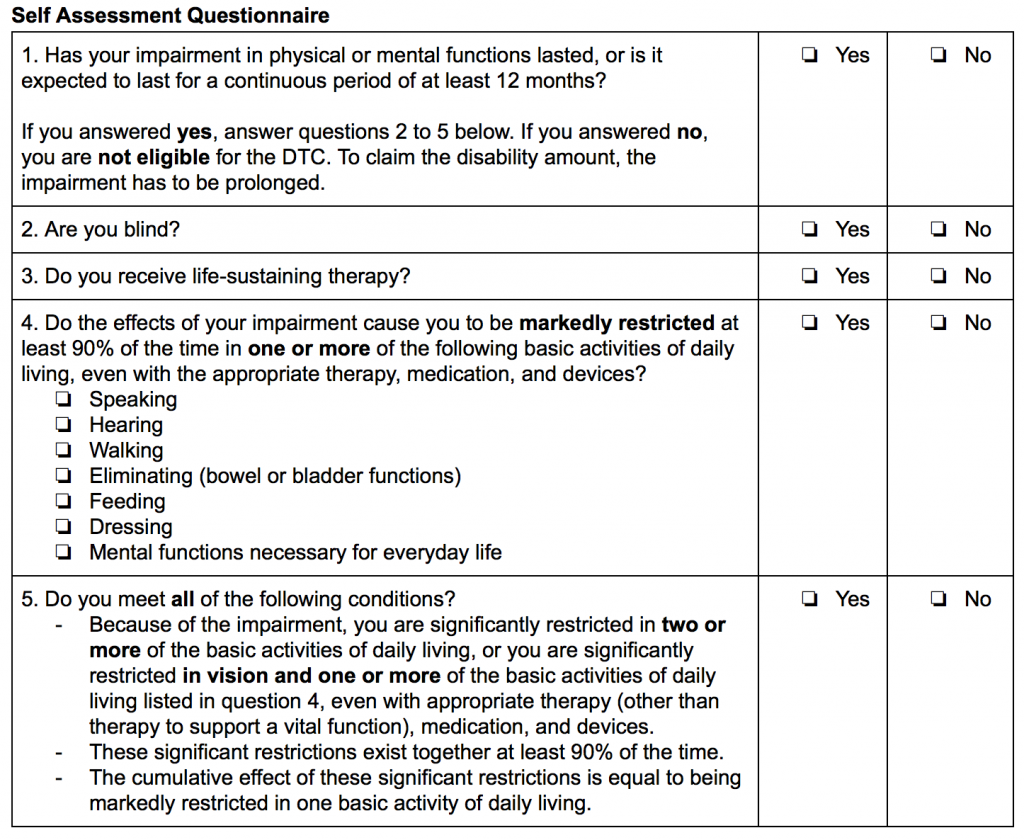

In addition to medical deductions, you may be wondering if you qualify for the Disability Tax Credit (DTC). Perhaps you heard about it through a friend, family member, or even your accountant. There are many things to consider before you apply for the DTC.

Typically the vast majority of our clientele will not qualify. Hearing loss and presbycusis (age related hearing-loss) is quite common in adults. The government has outlined various criteria an individual must meet before they are considered. Eligibility for the DTC is based on the effects of the impairment, not on the medical condition itself (CRA, 2018).

While you may have a severe or profound hearing loss, the CRA will only consider your application if your doctor and audiologist can provide compelling evidence that your routine daily activities are affected due to your impairment. Their criteria does not take into account your struggles in groups and in noise. If you can carry on a conversation in a quiet room with a familiar person while wearing your hearing aids or cochlear implant, without incurring significant breakdowns in the conversation, then you do not meet their requirements.

We have attached a Self Assessment Questionnaire provided by the CRA to help you see if you qualify. We highly recommend you complete this survey with another family member who can help you rate your difficulty hearing.

If you do not pass the self-assessment questionnaire and believe that you still may be a candidate, feel free to give us a call. Your audiologist would be happy to look over your latest hearing test and advise whether or not you could be eligible.

References:

Canada Revenue Agency. (2018). Disability tax credit. Retrieved April 10, 2018, from https://www.canada.ca/en/revenue-agency/services/tax/individuals/segments/tax-credits-deductions-persons-disabilities/disability-tax-credit.html